The Latest

BLOGS

Bigg Boss kannada season 10 winner – BBK10 Winner

The winner of Bigg Boss Kannada Season 10 is Karthik Mahesh, a popular Kannada film…

Bigg Boss 17 Grand Finale Photos, Video clips goes viral!

Bigg Boss 17 Grand Finale Photos, Video clips goes viral: Finally, Bigg Boss 17 has…

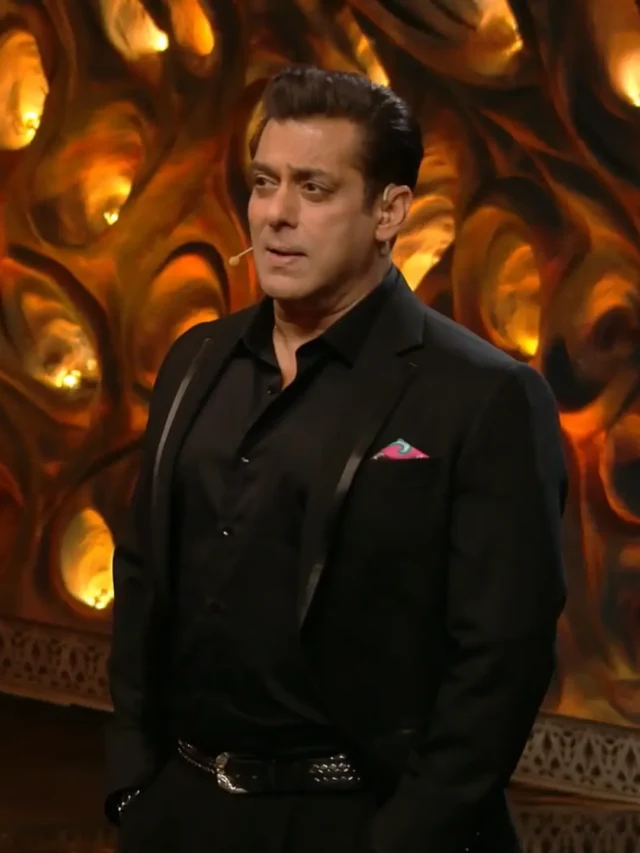

Salman Khan Bigg Boss 17 Fees – Salary of BB17 host Salman

Salman Khan Bigg Boss 17 Fees - Salary of BB17 host Salman :Salman Khan's Bigg…

Bigg Boss 17 winner prize money 2024 – Bigg Boss runner up prize money

Bigg Boss 17 winner prize money 2024 - Bigg Boss runner up prize money :…

How many Votes Munawar faruqui got in Bigg boss – Votes munawar faruqui

How many Votes Munawar faruqui got in Bigg boss - Votes munawar faruqui : Munawar…

Bigg Boss 17 Winner 2024 – BB17 Hindi Season Winner

The grand finale of Bigg Boss 17, the show that kept India glued to their…

Bigg Boss 17 Grand Finale Episode – 28 January 2024 Finale Episode

Bigg Boss 17 Grand Finale Episode - 28 January 2024 Finale Episode: Although there were…

Who is top 3 in Bigg Boss 17? Bigg Boss 17 Top 3

The grand finale of Bigg Boss 17, one of India's most popular reality shows, has…

Who Will Take Home the Bigg Boss 17 Trophy? BB17 Winner

Who Will Take Home the Bigg Boss 17 Trophy? As the clock ticks down to…